How To Calculate The $ And % Implied Move On A Stock Heading Into Earnings

How To Calculate The $ And % Implied Move On A Stock Heading Into Earnings - The first step to finding the implied move is to look for the ATM (At the Money) Straddle. A straddle is an options strategy involving the purchase of both a put and call option for the same expiration date and strike price on the same underlying security

To do this on Webull the first step is to type in the ticker. Let's use $TSLA for an example. Go to the options "strategy" tab and click straddle. Find the closest strike that is at the money. $TSLA closed at $142 so you would select the $142 straddle.

$13.70-$13.85 is the implied move on $$TSLA. If you take that amount and divide it by the current share price which is $142, you would take $13.80/$142 and the implied % move is 9.7%. This is how market makers price the implied move on a stock before earnings are released.

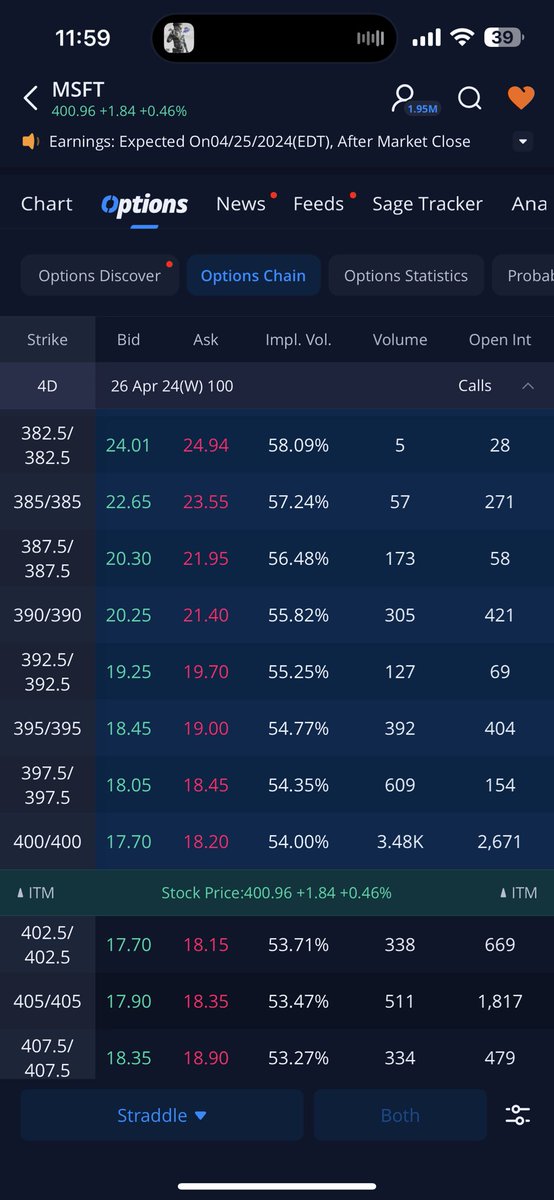

$MSFT the implied move here is $17.50 - $18.00. This could be to the upside or downside. This is about a ~4.5% move that market makers are pricing in.

It is best to calculate the implied move the day of or the day prior to the earnings report, because leading up to earnings other factors like implied volatility can change. This tool is useful to use because it can help you identify how a stock should perform after earnings.

If you think implied volatility is low, that’s when you want to be long options. If you think IV is high, that’s when you want to be an options seller. Thank you!

Posting Komentar